The Best Strategy To Use For Short Term Loan

Wiki Article

What Does Short Term Loan Do?

Table of ContentsTop Guidelines Of Short Term LoanShort Term Loan for BeginnersThe smart Trick of Short Term Loan That Nobody is DiscussingThe Definitive Guide to Short Term Loan3 Simple Techniques For Short Term LoanThe Main Principles Of Short Term Loan

What are temporary car loans? Temporary finances are unsecured personal lendings. This suggests that you do not have to use up assets to secure your financing, such as a residential property. Unsafe finances are offered to customers based entirely on the result of look at indicators like work standing, revenue, and also credit rating.

They are basic Using for a short-term car loan online is typically really straightforward, You will certainly be asked to provide some basic individual details, as well as evidence of your monetary status. Lenders will wish to know whether you are used and also how much your income is. They may additionally ask for your address information and also could examine your credit report, which will certainly allow them to figure out whether you have actually had difficulty repaying debts prior to.

The 30-Second Trick For Short Term Loan

Or else, the straightforward online application type is frequently all you require to complete before the cash remains in your bank. There is lots of selections Gone are the days when all of us required to rely on our high street bank to give us with loans. Borrowing online has become the norm and customers are significantly certain dealing with online monetary services firms that frequently supply much more flexible terms and far better prices than conventional financial institutions.This is because they can keep funding values little and also rates of interest are often fairly high in order to mitigate the threats entailed. Some lending institutions will take into consideration offering to debtors with bad credit scores ratings offering they can show they have a routine income in order to repay the lending. They are very controlled Supplying you borrow with a lender authorized and registered with the Financial Conduct Authority (FCA), they are bound by accountable loaning needs.

Negative aspects of temporary finances Higher rates of interest Due to the fact that unprotected short-term car loans lug greater threats for loan providers, in regards to the probability that borrowers will certainly default, rate of interest can be greater than for a few other types of funding. When picking which temporary finance service provider to opt for, it's wise to Short term loan examine the Complete Amount Repayable (TAR) figure, and the rates of interest billed.

Short Term Loan Fundamentals Explained

Despite the opportunity of added charges, FCA guidelines currently protect consumers from accumulating a debt spiral by capping overall rate of interest charged on temporary fundings. At the elevation of the cash advance car loans detraction, some debtors located that their interest and charge were accumulating quicker than they might maintain, especially if they missed out on a payment at any type of factor.You might also enhance your credit history score in the procedure.

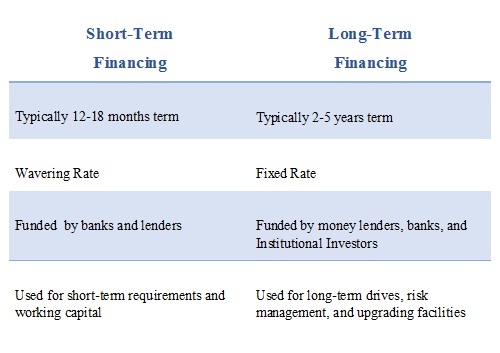

Temporary funding is a method to get money quick based off your credit rating, financial situation, and history with a loan provider. There are advantages and disadvantages to short-term financing, with advantages and disadvantages depending on why you're getting it and also what you're performing with it. An audio monetary plan goes a long way in optimizing one's temporary financing.

6 Easy Facts About Short Term Loan Shown

Right here are is a fast look on various benefits and downsides of short term funding: There are lots of advantages and also downsides of short-term funding. The one advantage that evaluates the most is the simplicity of applying. A temporary funding is normally for a smaller amount of cash than long-term fundings are.This means you can discover out faster whether you certify or not and also don't always have to wait very long to access the funds, either. Some lenders of temporary financing does not rely on debt ratings so much as evidence the finance's able to be settled.

You have to make repayments on temporary funding quickly and regularly. There is no 'missed repayments' on temporary fundings. This increases the advice stress on you to make sure those settlements occur which they are on-time. If there are not, you can sustain charges as well as charges that can paralyze your monetary circumstance.

All About Short Term Loan

This typically means complete payment in under a year. This assures a loan provider they can grant you a car loan and are going to get it back faster than long-term funding. This functions in your benefit as it does theirs, safeguarding financing for you swiftly. Even more individuals receive short-term financings.Somewhat, a longer term can guarantee you a reduced passion price. For some, this indicates paying a lot more as a result of the much shorter term. If you have high-interest financial obligations that need to be handled promptly, you may discover temporary funding to be helpful. Going right into financial debt to get out of debt appears counter-intuitive, thinking there's a way to pay this finance back.

What Does Short Term Loan Mean?

For that, temporary funding is better. If you make your payments on-time or are paying down your finance faster than anticipated, you might qualify for a lowered rate of interest price.If you're organized and also stay on top of the payment schedule, there shouldn't be any type of trouble bringing your finance to a verdict. Short term loan. Some sadly aren't so well organized as well as can tackle more financial debt that they can quickly. By great post to read not seeing where points are heading, one can really swiftly wind up in an opening.

Report this wiki page